FCRA, Credit Reports and Scores

The Credit Game – the FCRA, Credit Reports and Scores

By Bob Sullivan

A. The Fair Credit Reporting Act (FCRA) - Background

Federal law, the Fair Credit Reporting Act (FCRA), was enacted in 1971 giving people the right to see their credit records at credit reporting bureaus. Designed to improve the confidentiality and accuracy of credit reports, the law is enforced by the Federal Trade Commission (FTC) and state consumer protection agencies. Individuals may challenge and correct negative aspects of their record if they can prove there is a mistake. Consumers may also submit statements explaining why they received certain negative credit marks. Congress passed amendments to the FCRA that went into effect on October 1, 1997 which augmented consumers' privacy rights and further protected the accuracy of credit report information.. The amendments state that when a consumer disputes information, the consumer reporting agency and the original furnisher of the information must investigate the claim. Agencies must finish their investigations within 30 days and report their results back to consumers. The law also stipulates that there be a "date certain" for the calculation of the length of time that information can remain in consumer report files in situations involving collections or charge-offs. The FCRA was further strengthened by the passage of the Fair and Accurate Credit Transactions Act of 2003 (FACTA), which, among many other provisions, gave consumers the right to receive one free copy of their credit report annually.

The FCRA represents the first federal regulation of the consumer reporting industry, covering all credit bureaus, investigative reporting companies, detective and collection agencies, lenders' exchanges, and computerized information reporting companies.

The consumer is guaranteed several rights under the FCRA, including the right to a notice of reporting activities, the right of access to information contained in consumer reports, and the right to the correction of erroneous information that may have been the basis for a denial of credit, insurance, or employment. When a consumer is denied an extension of credit, insurance, or employment owing to information contained in a credit report, the consumer must be given the name and address of the credit bureau that furnished the credit report. Consumers are also entitled to see any report that led to a denial, but agencies are not required to disclose risk scores to them. Risk scores (or other numerical evaluation, however named) are assigned by consumer reporting agencies to help clients interpret the agency's report. Credit agencies may not report adverse information older than seven years or bankruptcies older than ten years.

The provisions of the FCRA apply to any report by an agency relating to a consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living. The FCRA covers information that is used or expected to be used in whole or part as a factor in establishing the consumer's eligibility for one of four purposes: (1) employment; (2) credit or insurance for personal, family, or household use; (3) government benefits and licenses to operate particular businesses or practice a profession; and (4) other legitimate business needs. Under the FCRA, an agency may also furnish a report in response to a court order or a federal grand jury subpoena, to a written authorization from the consumer, or to a summons from the Internal Revenue Service.

The FCRA creates civil liability for consumer reporting agencies and users of consumer reports that fail to comply with its requirements.

B. Consumer reporting agencies

Consumer reporting agencies (CRAs) are entities that collect and disseminate information about consumers to be used for credit evaluation and certain other purposes. They hold the databases which are the origins of a consumer's credit report. CRAs have a number of responsibilities under FCRA, including the following:

- Provide a consumer with information about him or her in the agency's files and to take steps to verify the accuracy of information disputed by a consumer. Under the FACTA laws passed in 2003, consumers are now able to receive one free credit report a year. Free reports are obtainable at annualcreditreport.com

- Conduct reasonable investigations into consumer disputes about incorrect information on their credit reports.

- If negative information is removed as a result of a consumer's dispute, it may not be reinserted without notifying the consumer within 5 days, in writing.

- CRAs may not retain negative information for an excessive period of time. The FCRA spells out how long negative information, such as late payments, bankruptcies, tax liens or judgments may stay on a consumer's credit report - typically 7 years from the date of the delinquency. The exceptions: bankruptcies (10 years) and tax liens (7 years from the time they are paid).

The 3 big CRAs: Experian, Trans Union and Equifax, do not interact with information furnishers directly as a result of consumer disputes. They use a system called E-Oscar.

C. Information Furnishers

An information furnisher, as defined by the FCRA, is a company that provides information to consumer reporting agencies. Typically, these are creditors, with which a consumer has some sort of credit agreement. (credit card companies, auto finance companies and mortgage banking institutions, to name a few). However, other examples of information furnishers are collection agencies (third-party collectors), state or municipal courts reporting a judgment of some kind, past and present employers and bonders.

Under the FCRA, these information furnishers may only report to a consumer's credit report under the following guidelines:

They must provide complete and accurate information to the credit rating agencies.

- The duty to investigate disputed information from consumers falls on them.

- They must inform consumers about negative information which has been or is about to be placed on a consumer's credit report within 30 days.

D. Users of the information for credit, insurance, or employment purposes

Users of the information for credit, insurance, or employment purposes have the following responsibilities under the FCRA:

- They must notify the consumer when an adverse action is taken on the basis of such reports.

- Users must identify the company that provided the report, so that the accuracy and completeness of the report may be verified or contested by the consumer.

E. Likelihood of errors on a credit report

A large number of consumer credit reports contain errors. A study released by the U.S. Public Interest Research Group in June 2004 found that 79% of the consumer credit reports surveyed contained some kind of error or mistake. Other studies have reported different fractions (from 0.2% to 70%), and many find around a 20-30% significant negative error rate. As a result, many consumers frequently invoke their rights under the FCRA to review and correct their credit reports.

F. Fines for violations of the FCRA

Under section 15 U.S.C. § 1681s of the FCRA, a wronged party may collect up to $1000 for each willful or negligent act which results in the violation of the FCRA. Any person may file suit in local federal court to enforce the FCRA.

G. Credit Scores

A credit score is determined by a numeric index estimating an individual's creditworthiness and ability to repay financial obligations, taking into account promptness in paying bills, length of credit history, available credit actually used, bankruptcy, and other negative events, and other factors. The three major American credit reporting agencies all use variations of the scoring model originally developed by Fair Isaac & Company, Inc., (FICO) under different names:

Credit Reporting Agency FICO Score Names:

Equifax - BEACON®

Experian - Fair Isaac Risk Model

TransUnion - EMPIRICA®

FICO scores range from about 300 to a high of 850, with a score above 720 generally considered a "good credit" and a score below 600 a higher risk. Variations in credit scores can occur because credit reporting agencies process information in a borrower's credit report in different ways.

Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to consumers and to mitigate loss to bad debt. Lenders use credit scores to determine who qualifies for a loan, for what interest rate, and what credit limits.

H. The FICO score and others

FICO is an acronym for Fair Isaac Corporation (traded publicly under the symbol FIC) and refers to the best-known credit score model in the United States. The FICO score is calculated using statistical methods, developed by Fair Isaac, to information in one's credit file. The FICO score is primarily used in the consumer banking and credit

industry. Banks and other institutions that use scores as a factor in their lending decisions may deny credit, charge higher interest rates or require more extensive income and asset verification if the applicant’s credit score is low.

FICO scores are designed to indicate the likelihood of a borrower being delinquent within the next 24 months. No public information is available to determine what the scores mean in terms of statistics. A separate score, BNI, is used to indicate likelihood of bankruptcy.

The three major credit reporting agencies (also often, but inaccurately referred to as credit bureaus) in the United States, (Equifax, Experian and Trans Union) calculate their own credit scores, which go by different trademark names as well as many different versions of the score.

The scores use a multiple scorecard design. Each version uses 10 or more individual scorecards, and an individual is typically compared with similar others. (For example, a borrower with two 30-day late payments will be scored against a population with some minor delinquencies.) An individual is then graded according to what variables seem to indicate a repayment risk in that group. This feature may cause a borrower with delinquencies to score in the same range as a borrower without delinquencies.

Nearly all large banks also build and use their own proprietary statistical models for credit scoring purposes, often in conjunction with the FICO score or other outside scores.

The statistical models that generate credit scores are subject to federal regulations. The Federal Reserve Board's Regulation B, which implements the Equal Credit Opportunity Act, expressly prohibits a credit scoring model from considering any prohibited basis such as race, color, religion, national origin, sex, or marital status. Regulation B also stipulates that credit scoring models must be empirically derived and statistically sound. Furthermore, if an adverse action is taken as a result of the credit score (e.g. an individual's application for credit is denied) then specific reasons for the denial must be provided to the individual. A statement that the individual "failed to score high enough" is insufficient; the reasons must be specific.

Each of the credit reporting agencies has developed its own version of the credit score intended to compete with Fair Isaac's score. Although not as widely used, these scores (for example Trans Union's "TransRisk" score or Experian's "ScoreX" and "PLUS" scores) are less expensive than the FICO score. These scores are often derisively referred to by consumers and lenders as "FAKO" scores, for they do not use official Fair Isaac methodologies. The cost savings of a non-FICO score are tempting to some banks and credit card companies, who need an accurate risk assessment on millions of accounts every year. For ease of use, these scores tend to be mathematically scaled so that they fall in the same general range as the FICO score. Fair Isaac offers scoring models for the U.S., Canada, and South Africa. It also offers a "Global FICO" for many other countries.

I. Makeup of the credit score

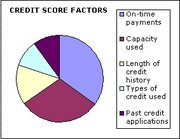

The approximate makeup of the FICO score Fair Isaac discloses to consumers

Credit scores are designed to measure the risk of default by taking into account various factors in a person's financial history. Although the exact formulae for calculating credit scores are closely guarded secrets, Fair Isaac has disclosed the following components and the approximate weighted contribution of each:

- 35% punctuality of payment in the past (only includes payments later than 30 days past due)

- 30% the amount of debt, expressed as the ratio of current revolving debt (credit card balances, etc.) to total available revolving credit (credit limits)

- 15% length of credit history

- 10% types of credit used (installment, revolving, consumer finance)

- 10% recent search for credit and/or amount of credit obtained recently

The above percentages provide very limited guidance in understanding a credit score. For example, the 10% of the score allocated to "types of credit used" is undefined, leaving consumers unaware what type of credit mix to pursue. "Length of credit history" is also a questionable concept; it consists of multiple factors - two being the oldest account open and the average length of time an account has been open. Although only 35% is attributed to punctuality, if a consumer is substantially late on numerous accounts, his score will fall far more than 35%. Bankruptcies, foreclosures, and judgments affect scores substantially, but are not included in the simplistic pie chart provided by Fair Isaac.

Further, Fair Isaac does not use the same "scorecard" for everyone. The scorecards are segmented so that there are over 100 different actual scoring models that are applied to different individuals based on different ranges of input values (some scorecard segmentations include: age, depth of credit history, etc.) The implications of this segmentation are that while the approximate weighted contribution above may be an average across all scorecards, individuals will receive different scores or weightings based on the scorecard segmentation that they fall into. Some consumers have noticed their scores decreasing by small amounts for no apparent reason.

Current income and employment history do not influence the FICO score, but they are weighed when applying for credit. For instance, an unemployed individual with no other sources of income will not usually be approved for a home mortgage, regardless of his or her FICO score.

There are other special factors which can weigh on the FICO score.

- Any monies owed because of a court judgment, tax lien, or similar carry an additional negative penalty, especially when recent.

- Having above a certain number of consumer finance company credit accounts also carries a negative weight (critics say that this causes a vicious cycle, locking people into continuing to use consumer finance companies).

- The number of recent credit checks also can weigh down the score, although the credit agencies claim to allow for credit checks made within a certain window of time to not aggregate, thus allowing the consumer to shop around for rates.

J. Range of scores

A FICO score generally ranges from 300 to 850. It exhibits a left-skewed distribution with a US median around 725. 660 is generally regarded as potentially sub-prime and represents an important break point for creditworthiness. The performance of the scores is monitored and the scores are periodically aligned so that a credit grantor normally does not need to be concerned about which score card was employed.

Each individual actually has three credit scores for any given scoring model because the three credit agencies have their own, independent databases. These databases are independent of each other and may contain entirely different data. Many lenders will check an applicant's score from each bureau and use the median score to determine the applicant's credit worthiness.

K. Reasons for disputes on credit reports:

Types of accounts (individual/joint):

- Charge off account

- Collection account

- Open account

- Mortgage account

- Credit card account

- Installment account

- Revolving account

Payment history incomplete, inaccurate or omitted thus prejudicial:

- No commencement date (month and year) of delinquency immediately preceding the collection so as to determine appropriate 7 year period

- Not client’s account

- No closing date of account is listed

- No exact dates are listed to verify information

- No balance/limit information given

- On time payments information missing

- Account has already been paid and nothing is owed – removal requested

- Not client’s report

- Not client’s address

- Date reported not accurate

- Bankruptcy information is incomplete

- Payment and terms information is omitted – no specific dates listed as to when it was entered or paid off

- Bankruptcy is over 7 years old – removal requested

Call 954-966-0111 today for a FREE consultation with an experienced attorney, not a paralegal.

It's Time to Protect Your Rights - Call 954-966-0111 today